Insolvency Australia publishes the Q3 Corporate Insolvency Index

Is the insolvency drought ending? The signs are certainly starting to appear, the latest Corporate Insolvency Index*, produced by Insolvency Australia and sponsored by insurance broker PRM shows.

To download the reports, click here.

The Q3 statistics showed that while total appointments are still low, they have risen slightly (6%) compared with the previous comparative period. In particular, Court-appointed liquidations rose 114% compared with the 2021 third quarter. Voluntary administrations were down significantly (-35%) but creditors voluntary liquidations and controller appointments both rose.

“It’s certainly an indication that the insolvency market is heading towards normalisation – although there’s still some way to go,” says Gareth Gammon, Insolvency Australia Director. “Businesses are now under increasing pressure, the ATO is calling in its markers – as are the banks – and credit reporting agencies are gearing up. The ATO has even said it is expecting an increase in insolvencies.

“We’re expecting the full-year figures to provide even more solid evidence of the changing market. We’re hearing from Insolvency Australia partners that the first ‘wave’ will begin post-election and tax season, with zombie companies leading the march. We recently did a straw poll among our partners and the majority said that in 2022 they expect to see more matters but with lower average fees. That could certainly point to the zombies and smaller, less complex matters being handled.”

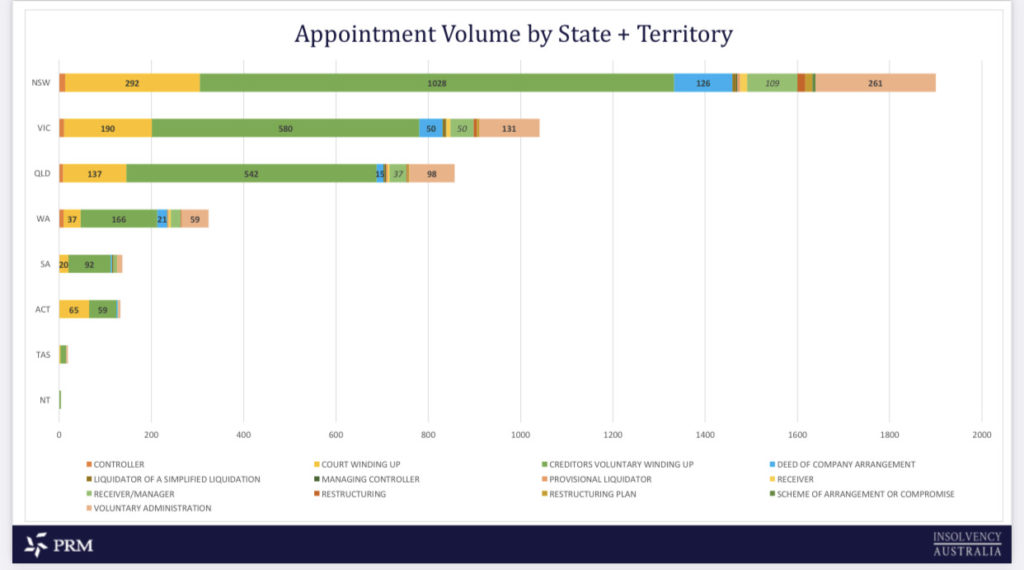

According to the report, for the first 3 quarters of FY21-22 NSW saw the most insolvencies recording 1900 appointments; Victoria recorded 1041; Queensland 857; WA 324; SA 137; the ACT 133; Tasmania 19; and the Northern Territory 4. Of these, the most prevalent appointments were Court windings-up.

If you, a client or anyone in your network requires expert assistance with a potential insolvency matter, please reach out for help from any one of of almost 700 registered professionals listed on our website. Insolvency Australia is free to use and as we do not take on any appointments or fees for referrals, we are independent.