Biting financial pressures causing insolvency surge, the Insolvency Australia Corporate Insolvency Index shows

Local and global pressures are putting increasing strain on businesses, which is translating into rising insolvencies, according to the latest Corporate Insolvency Index* produced by Insolvency Australia.

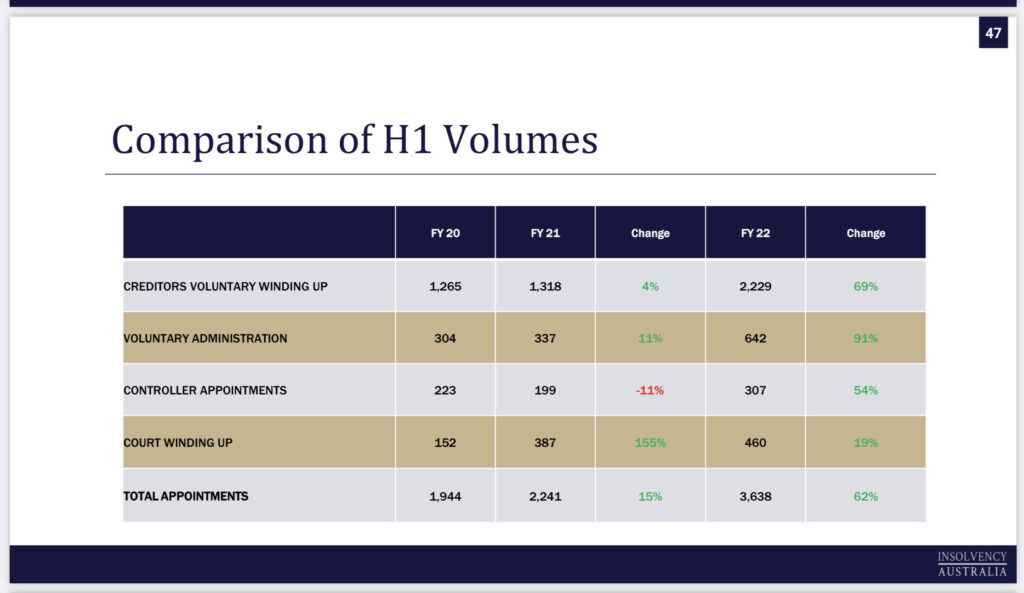

In the first half of FY23, external administrator and controller appointments rose by 62 per cent compared with the previous corresponding period. And the Corporate Insolvency Index shows NSW had the most insolvencies over the six months, recording 2153 appointments in the first 6 months, compared to 2402 in the whole of FY22; while Victoria recorded 1,192 appointments; Queensland 796; WA 346; SA 133; the ACT 96, and Tasmania and the Northern Territory both had five.

“As the ATO came down harder on those with tax debt, it resulted in increasing external administrations,” says Gareth Gammon, Insolvency Australia Director. “We started 2023 just as we finished 2022, with rising interest rates, surging cost of living, labour and materials shortages and the tax office continuing its tougher debt collection stance.”

Patrick Coghlan, CreditorWatch CEO, says those pressures are also reflected in low business confidence and that cost of living pressures and low wages growth are impacting consumer confidence. “Our forecast is for business conditions to worsen across the next 6-12 months, particularly if the RBA increases rates further which seems a certainty,” he says.

“While many individuals and businesses had priced in at least one further rise to the cash rate, two more will present real serviceability problems to small businesses, particularly those in areas and sectors where demand is likely to drop or is already dropping, such as hospitality.”

And while the construction sector continues to be the worst offending industry when it comes to the proportion of businesses in arrears by 60 days or more, Coghlan says in terms of defaults, it’s the food and beverage services sector that has the highest probability of default. “This sector suffered the worst during COVID lockdowns and is now challenged by higher costs and labour shortages. We expect insolvencies to increase across 2023 as cost-of-living pressures reduce consumers’ disposable income and they are less inclined to visit restaurants, cafes and other hospitality venues,” he says.

“Our modelling has projected default rates rising over the next 12 months, backed up by deteriorations in key trade indicators – i.e., trade receivables, external administrations and court actions.”

Jarvis Archer, Revive Financial’s Head of Business Restructuring & Insolvency and the top liquidator by appointment nationwide for HY23, says: “Construction and hospitality businesses seem to represent higher volumes of appointments. They’re looking to clean up accrued pandemic debts with a restructure or, if they can’t trade profitably post-pandemic, call it a day on their business.”

Archer adds that the ATO “seems to have again stepped up recovery efforts in 2023,” with high levels of winding up filings and statutory demands popping up, sometimes also accompanied by a Director Penalty Notice. “[This year] is likely to be the toughest year in recent times for Australian businesses,” he says. “The ATO’s escalating approach, together with ongoing staffing and supply chain issues and economic pressures may create a perfect storm for many business owners who have already battled for three years.”

Resources sector buoying WA economy

In WA, the resources sector will help buoy the local economy, says Natasha Petrie, BRI Ferrier Director. “For that reason, I think the economy in the West will be in a better position than Eastern states. However, I believe appointments will increase over the next 6-12 months, with inflation, ATO debt collection and supply shortages being primary drivers. The ATO and its recovery processes will be the sleeping giant. How they approach recovery of the outstanding debt will have a significant impact on business failure.”

To register for the report, go to: Corporate Insolvency Appointment Reports – Insolvency Australia