Insolvency Australia: ‘True picture’ of insolvencies emerging, latest insolvency index finds

‘True picture’ of insolvencies emerging, latest insolvency index finds

The end of COVID support measures means the true picture of insolvencies in Australia is now beginning to emerge, the latest Corporate Insolvency Index*, produced by Insolvency Australia and sponsored by insurance broker PRM, shows.

In the FY22 year, external administrator and controller appointments rose by 8 per cent compared with the previous financial year. That follows a 40 per cent fall during the FY21 period compared with the previous year.

“There are certainly signs that the insolvency sector is now turning the corner, but we’re not yet at pre-COVID levels,” says Gareth Gammon, Insolvency Australia Director. “However, the myriad economic pressures on businesses and individuals and the push by the ATO to collect debts means we are likely to see a further increase in corporate and personal insolvencies over coming months and into next year. There will be a domino effect, as the pain threshold will be too much for many to bear – particularly SMEs whose cash reserves have been exhausted by factors beyond their control.”

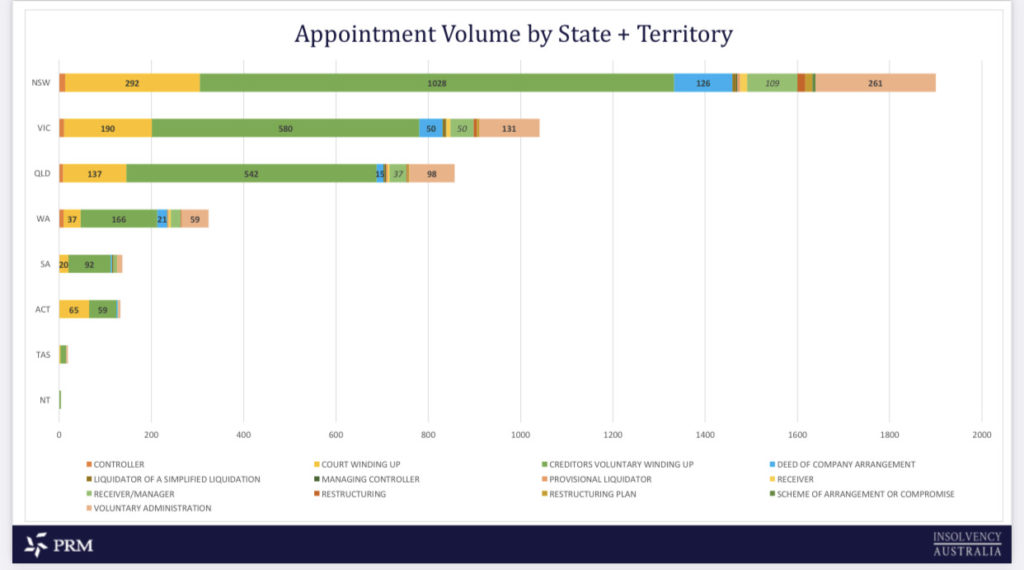

According to the Corporate Insolvency Index, NSW had the most insolvencies over the year, recording an 11 per cent increase in total appointments (2,402); Queensland recorded 1,218 appointments, a 22 per cent rise; Tasmania saw a 188 per cent increase to 49; the NT had an 87 per cent increase to 56; South Australia’s appointments rose 16 per cent to 227; and WA rose 5 per cent, to 549. Conversely, Victoria recorded a 3 per cent fall in insolvencies (1,954 in FY22 compared with 2,019 in the previous year), while the ACT saw a 17 per cent decrease (100 appointments compared with 120).

Patrick Coghlan, CreditorWatch CEO, says that NSW has a “disproportionately high number of insolvencies compared to other states”.

“While 31 per cent of the Australian population resides in NSW, 45 per cent of all insolvency appointments are in NSW,” he says. “Acknowledging that NSW may have a higher proportion of insolvencies due to nationally focused businesses being headquartered there, the data does align with our BRI ‘Best and Worst Regions’ data.

In July, five of the 10 most at-risk locations for business default were in NSW, while only two of the top 10 lowest risk regions were in that state.“What this tells us, is that businesses need to keep on top of what the presiding risk factors are for businesses over the upcoming years. Obviously, a range of industry specific and economic factors are at play, however, understanding risk by area is clearly a metric that can help businesses price risk more effectively.”