ATO and creditor action poses greatest risk to SMEs, says Insolvency Australia

- News

-

10 Aug 2023

- Share post

ATO and creditor action poses greatest risk to SMEs, says Insolvency Australia

The ATO and other creditors currently pose the greatest ‘threat’ to cash-strapped SMEs, says Insolvency Australia, which has just released its latest Corporate Insolvency Index.

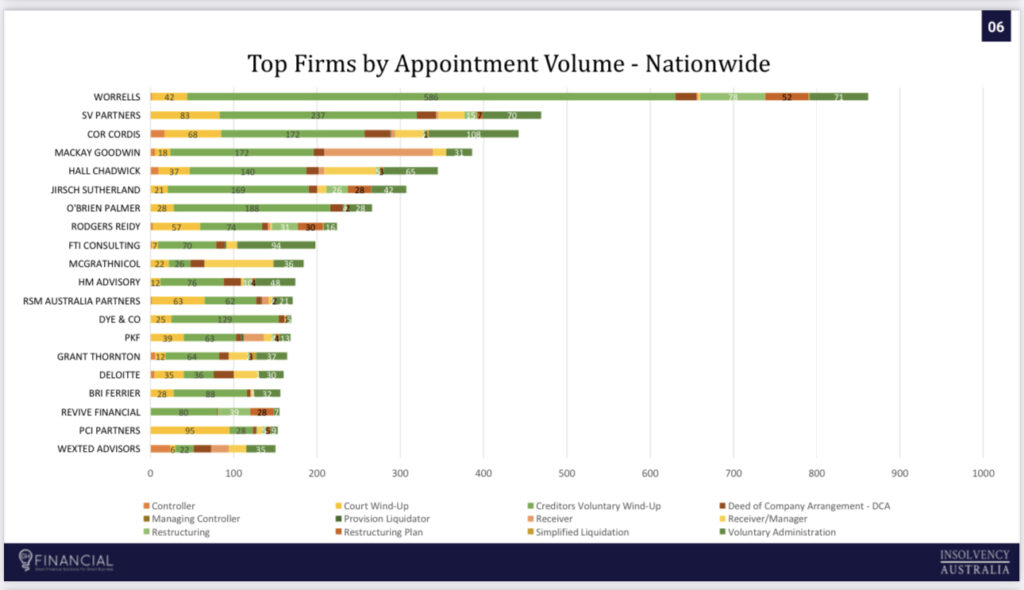

The Corporate Insolvency Index, produced by Insolvency Australia and sponsored by G&H Financial, outlines the volume of external administrations around Australia, as well as the top insolvency firms and top liquidators by appointment.

The Q4 statistics show a 57% increase in appointments nationally, compared with the previous corresponding period (3,008 vs 1,921). In terms of volume, NSW was at the forefront, recording 1,169 corporate insolvencies. Tasmania recorded the greatest percentage increase (133%), followed by the ACT (64%), while NSW and QLD both recorded a 59% uptick, VIC had a 54% rise, SA 52%, and WA saw a 50% increase. The number of insolvencies in the NT remained unchanged from the previous year.

“It’s been a tough year, with a significant increase in winding-up applications and ATO-initiated Court recovery, particularly over the past quarter,” says Gareth Gammon, Insolvency Australia Director. “Over the past year there’s been plenty of discussion in the sector about the incoming insolvency wave. It started with a trickle and it’s now become more of a surge as economic pressures and the ATO’s debt collection activities combine to create the perfect storm. Beyond this last quarter, we’re now seeing an increase in Court wind-ups by the big four banks, which means the next few months could well be equally challenging.”

Jirsch Sutherland Partner Chris Baskerville, a member of Insolvency Australia, says he expects insolvencies to continue to increase in the back half of the 2023 calendar year. “The rise in insolvency appointments can be directly attributed to the increase in ATO enforcement action. Its enforcement of outstanding debts is reaching, if not surpassing, pre-pandemic levels,” he says. “The ATO appears to be less amenable to payment arrangements, especially those that propose greater than two years.”

John Morgan, a Director and founder of BCR Advisory, says, “The number of insolvency appointments will continue to increase as businesses struggle with the impact of the RBA’s interest rate hikes and the expected increase in collection pressure from the ATO. The construction industry is in a very poor state as the cost of money and materials continues to increase, and we have also seen an uptick in the number of cafes and restaurants looking for insolvency advice.”

Petr Vrsecky, Insolvency Australia member and Partner with PKF Melbourne, says another wave of insolvencies could be coming if the fixed rate mortgage cliff causes distressed selling and any significant drop in property prices. “That may well be the catalyst,” he says.

“Interest rates continue to dampen consumer spending, and therefore it seems inevitable that businesses will be adversely affected. There’s meant to be a recycling of capital, meaning that inefficient businesses fail and better managed businesses get more capital allocated to them. It would therefore seem inevitable that the rate of insolvencies must increase following the ‘pandemic era’ interference and taxpayer support, which made it too easy to operate businesses that had no place being there,” Vrsecky says.

Fellow Insolvency Australia member Joshua Taylor, founder ofTaylor Insolvencies, says high interest rates along with ATO action are also likely to lead to an increase in personal insolvencies. “If rates stay high or push even higher, that will put pressure on the housing market, which will lead to an increase in bankruptcies,” says Taylor, who is a dual Bankruptcy Trustee and Registered Liquidator. “Personal insolvencies have been more subdued but I see the bankruptcy / personal debt sector picking up steam.”

Small Business Restructuring ‘in favour’

Chris Baskerville says a positive change in the past year has been the increasing desire by eligible small businesses to undertake Small Business Restructuring (SBR) plans “given the significant number of small businesses carrying less than $1 million in debt”. “SBRs will continue to increase commensurate with the education of trusted advisers,” he says. “As they get more familiar with the concept, the more it will be promoted. In terms of the number of appointments, I believe SBRs will overtake voluntary administrations in the future.”

For a copy of the Corporate Insolvency Index, go to: Corporate Insolvency Appointment Reports – Insolvency Australia